Finbond Mutual Bank Loan for SASSA Beneficiaries in 2025

As a matter of fact, millions of South Africans rely on grants from the South African Social Security Agency (SASSA) to accommodate their everyday needs. However, the financial hardships of unexpected tariffs often compel beneficiaries to look for loans.

Based on my findings, the Finbond Mutual Bank Loan for SASSA Beneficiaries is an offer from one of the financially significant institutions. They are providing them with access to further financial support when required.

But is this a fine option?

Yes, It is. SASSA beneficiaries can avail themselves of a loan ranging from R5 00 to R20 000 with a flexible repayment period of 2 years. You can take a look at the loan amount and the requirements, too, as follows.

Finbond Loan Overview

Requirements to Apply

Suppose you meet the above requirements. Then apply for a quick loan. Furthermore, I would like to point out that SASSA beneficiaries must meet the requirements for Finbond Bank online loans, as the eligibility criteria are largely identical for both SASSA grants and Finbond loans.

Apply for an Instant Loan

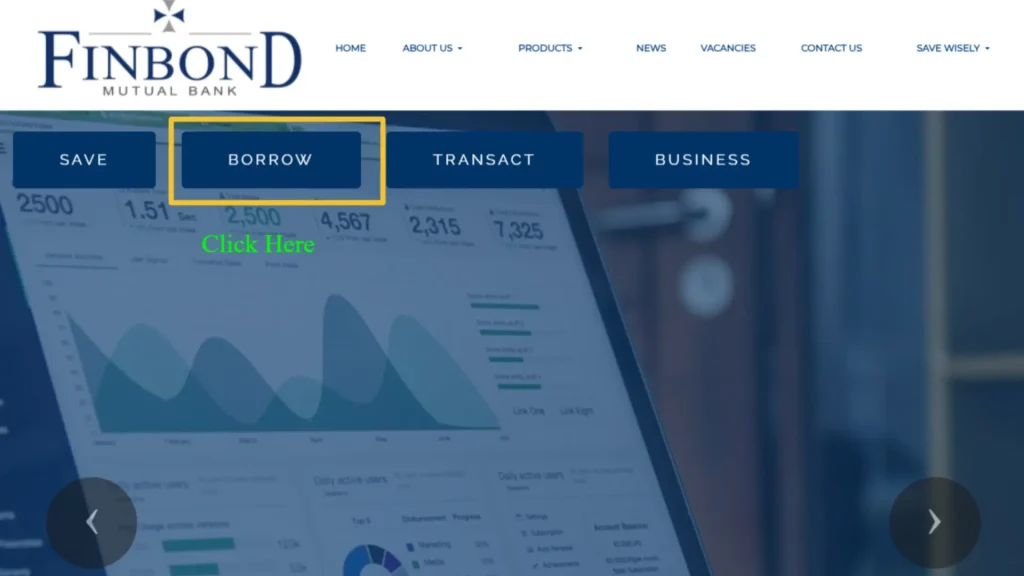

Follow these steps to select one of these instant loans according to your preference.

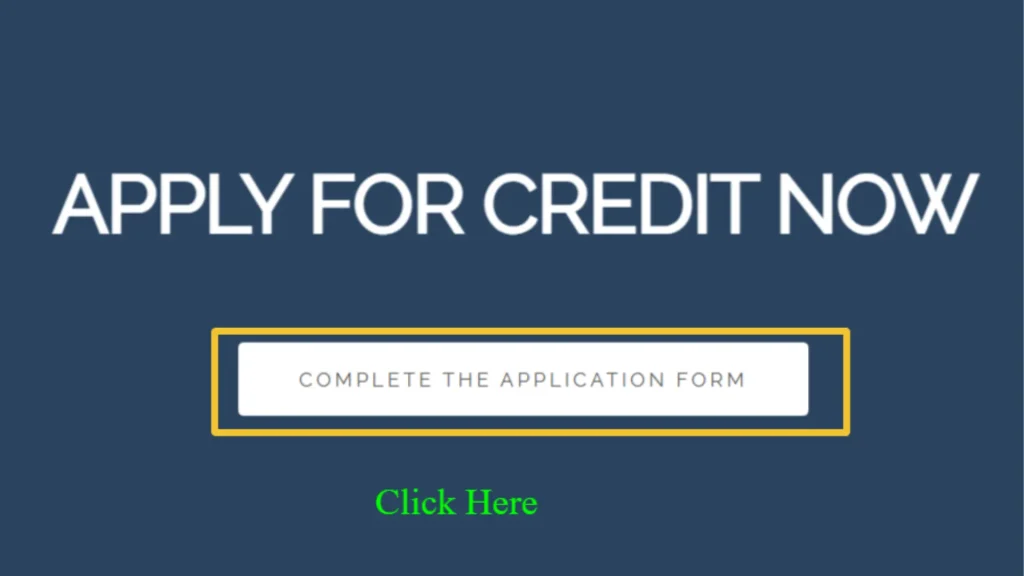

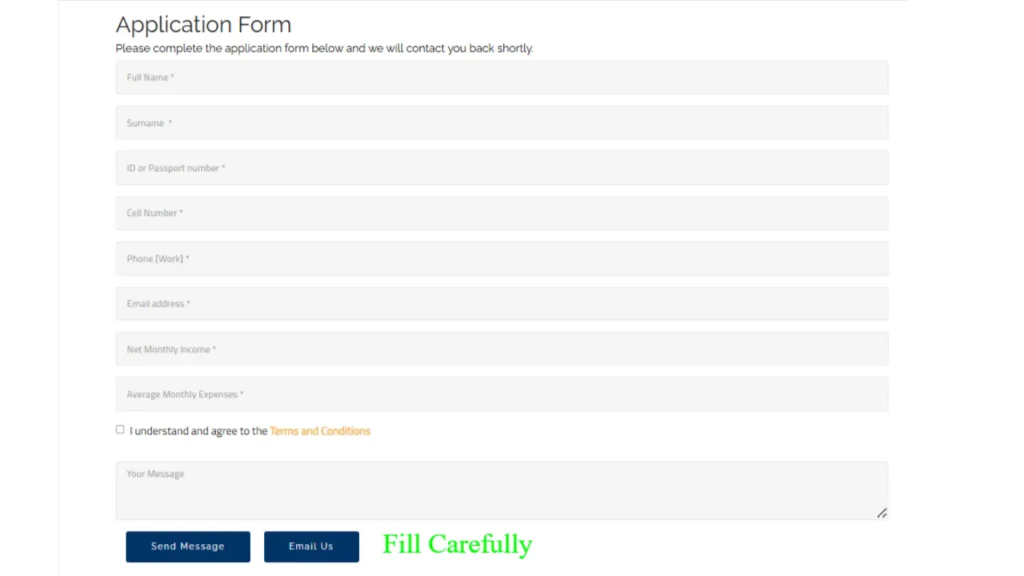

Alternatively, you can also apply for a loan through their website. This is a more comprehensive and reliable method. In my opinion, you should opt for this method. Moreover, the process is as follows.

Apply for a Finbond Mutual Bank Loan for SASSA Beneficiaries?

Once the loan application is submitted, you don’t need to lift a finger. Findbond will conduct its internal process and then contact you to inform you whether your loan has been approved or declined. If your requirement is declined, a deficiency will be noted, and you will need to rectify it. You can then reapply.

This process is as easy as pie, allowing you to obtain the loan quickly and easily.

Key Takeaways

SASSA Does Not Offer Loans Directly

SASSA does not provide loans itself. It offers loan facilities through its affiliated platforms, such as Finbond, EasyPay Everywhere, Capitec, and Shoprite, among others. These platforms extend valuable assistance to SASSA recipients in obtaining loans according to their loan eligibility.

Criteria for SASSA Grant Recipients

You may qualify for a loan from reputable providers like Shoprite, Capitec Bank, and Finbond. Typically, eligibility requires a valid ID, grant income, and an active bank account or a receipt for receiving funds.

Caution When Borrowing

It is essential for you to borrow from the above-mentioned registered lenders and avoid predatory lending practices. Additionally, you can explore alternative financial assistance options, such as community programs and government subsidies, such as NSFASA, NYDA, and SEFA. This can help you reduce the need for nonessential debt.

Summarize

SASSA grants are a means of survival for many South Africans. However, they are often insufficient to cover unexpected expenses, such as medical emergencies, home repairs, school fees, or funeral costs. With the rising cost of living, many beneficiaries turn to microloans to help cover their expenses.

Remember, receiving a SASSA grant provides significant financial support for those in need. However, it cannot always cover unexpected expenses or emergencies, as I explained. As a result, many beneficiaries find themselves wondering whether they can apply for a loan based on this income. Yes, you can, if you meet the eligibility criteria and can afford to repay the loan.

Borrowing a loan is a short-term financial solution for immediate needs. You need to always keep in mind. Loans can act as a bridge to bridge a financial gap. However, they also come with risks, including high interest rates and the potential for financial stress.

Therefore, it’s essential to maintain a balanced approach to your financial affairs.

FAQs

1. Does Finbond give loans to SASSA beneficiaries?

Yes, Finbond Mutual Bank extends loans to SASSA beneficiaries depending on the loan amount. This is a minimum of R5 00 and a maximum of R20 000. They offer a flexible repayment period of 2 years. If you meet their criteria, which is that you must have a valid South African ID card and be a current SASSA grantee.

2. What is the interest rate on Finbond?

Interest rates at Finbond Bank start at 7% on loans. These are fixed charges. For larger amounts, this will be increased to 9%. For SASSA beneficiaries, there are no fixed charges on loans. Remember, Finbond is a mutual investment bank. It also offers interest on investments. They pay on a monthly basis. Their interest rates on savings accounts range from 7.5% to 9.25% for 6-72 months.

3. What is the loan for SASSA beneficiaries?

SASSA does not offer direct loans; however, some institutions provide loans to SASSA beneficiaries. And they are Capitec, Finbond, Shoprite, and Easypay Everywhere. Grantees can avail loan facilities from all the above-mentioned organizations. They provide loans for small and simple needs. Their repayment criteria are suitable, and there are no interest charges.

4. Which bank is good for SASSA?

There are many options for receiving SASSA grant money. A large number of recipients use the SASSA Black Card, which is a product of Postbank. However, in my opinion, TymeBank is a more suitable option for SASSA grants in 2025. They have the TymeBank Minute Switch app for grants, which allows them to view their balance, amount, and even transfer money wherever needed.