How to Apply for a PEP Loan in Sep 2025?

SASSA pays a lump sum amount to its grantees, which is sometimes not enough for them. Therefore, most of them are looking for loans that can be easily repaid, without any additional fees or interest. Based on my observation, PEP loans (Powered by Capfin) are highly suitable for SASSA beneficiaries, employed or unemployed. If you are looking for such a loan, this is for you.

Apply at your own ease!

Before applying, you must meet 03 basic requirements. If met, you can proceed.

What are these?

As long as you tick these boxes, you are eligible and can proceed with your loan application to PEP alongside Ackermans. Don’t be confused, Ackermans is a huge retailer with 700 branches in South Africa, and it is also powered by Capfin too.

A Quick Intro to Capfin

Capfin operates under the Pepkor group of companies. They offer comprehensive financial assistance and services. Most notably, they have collaborated with PEP and Akermans. Meanwhile, through this partnership, anyone, including SASSA beneficiaries, can apply for personal loans nationwide. Clients can also avail themselves of loan facilities directly from Capfin.

Intro to PEP

As you may know, PEP is a popular retail chain in South Africa, with stores operating across the country. It offers affordable clothing, footwear, home accessories, and other everyday essentials. However, PEP does not provide loans directly. Instead, it has partnered with a trusted financial service provider called Capfin. As a result, PEP is a facilitating company for all loans given to end-users, and Capfin is the financial agency that backs them.

There are now two ways to apply, which I would like to explain: online and in-person at their office.

Remember, the application process remains the same in all three cases, regardless of whether you are unemployed, employed, or a SASSA grant recipient. Let’s first examine the online application method tailored to your specific financial situation and then the in-person method.

How to Apply Online

If you encounter any obstacles applying online, you can opt for the in-store option at PEP and Ackermans.

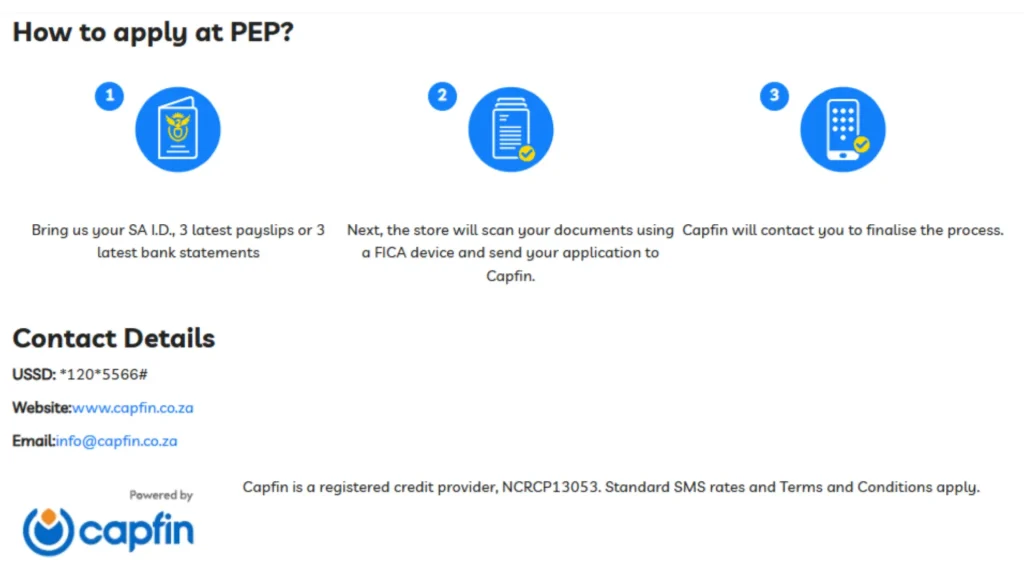

How to Apply for a Loan Through PEP and Ackermans

The process of applying for a loan on these two platforms is the same. You must ensure that you are registered with both of these retailers before proceeding with financial assistance.

Gather Documents

Pick your identity proof, 03 latest pay slips, and a bank statement of the last 03 months consecutively.

Locate a Store

Locate any PEP or Ackermans store; if you have difficulty, browse the Capfin website for assistance.

Scan Documents

A representative in both stores will receive and scan your documents. And gave a receipt to you.

Submit Application

The relative outfit will send the documents to Capfin for further loan proceedings.

Keep In-Touch

Capfin will review and process all your documents, and then contact you to inform you of the outcome, whether acceptance or rejection.

The said process is only for seekers who want to visit PEP or Ackermans stores. Now, I will guide you by explaining the process, “How to Apply Loan Capin Directly”.

How to Apply for a Loan Through Capfin Directly?

Furthermore, if you want to calculate your loan amount and its monthly installment, click on the image below.

How to Qualify for PEP Loans While Unemployed?

You are still eligible for a PEP loan if you are unemployed. This is because you are usually required to show a reliable source of income before you can borrow. In short, if you do not meet the PEP eligibility matrix, it becomes difficult to qualify.

Here are several important points to note. First, whether you are unemployed, employed, or a SASSA grant recipient, you can apply for a loan. How? As you know, one of these requirements is a bank statement or a salary slip.

If you are employed or receiving one of the SASSA grant, meeting these requirements is straightforward, as your monthly income is considered a reliable indicator of repayment ability.

But how do you meet them if you are unemployed?

If you are unemployed, there is no need to worry. You do not have a payslip or bank statement. So, what should you do? The simple solution is that you still need to provide your bank statement, regardless of whether it contains any transactions.

Obviously, the only requirement is that you have a bank statement, not whether or not there have been any transactions in it.

Additionally, if you have worked somewhere before, you can provide your previous pay slip. However, if you have never worked, a blank bank statement will suffice. When applying for a PEP loan, keep in mind that the condition of PEP loans is to prove your ability to repay the loan from your own resources.

In some cases, self-employed individuals, those earning rental income, or those receiving regular payments from clients may also qualify for a loan.

Application Process

The application process for PEP loans is akin to a five-finger exercise, but it is crucial to ensure you are working with a reputable lender. Their process is simple. They prepare the result after analyzing the required documents. If your funds are approved, the money will be transferred to your bank account within a few business days. If you do not meet the criteria, you are notified of the reason.

PEP Loan Overview

The economic hardships of unemployment in South Africa are staggering today. If you have recently lost your job and are struggling to support your family, you may be wondering about the financial assistance available to you.

Or, people searching for this term are typically grantees seeking accessible, low-risk loan options. They may be unemployed, under financial strain, or simply seeking short-term assistance.

Their intention is clearly to find legitimate financial assistance options that do not involve formal employment, complicated paperwork, or high interest rates. While being unemployed or relying on SASSA grants can be financially stressful, you still have options.

PEP loans offer a reliable, accessible way to get through tough times, as long as you meet basic needs. Always borrow responsibly and understand your repayment terms. If you use it wisely, a PEP loan can be the short-term help you need without the long-term burden. You can apply online or in person at their offices.

Can I apply for a PEP loan online?

Yes, you can apply for a PEP loan whether you are employed or unemployed. Or you are receiving a grant from a South African government agency. All you have to do is send an SMS to 33005 and follow the instructions you receive from PEP. If you face any problems during the process, you can contact PEP directly on their WhatsApp number, which is 066 000 0683.

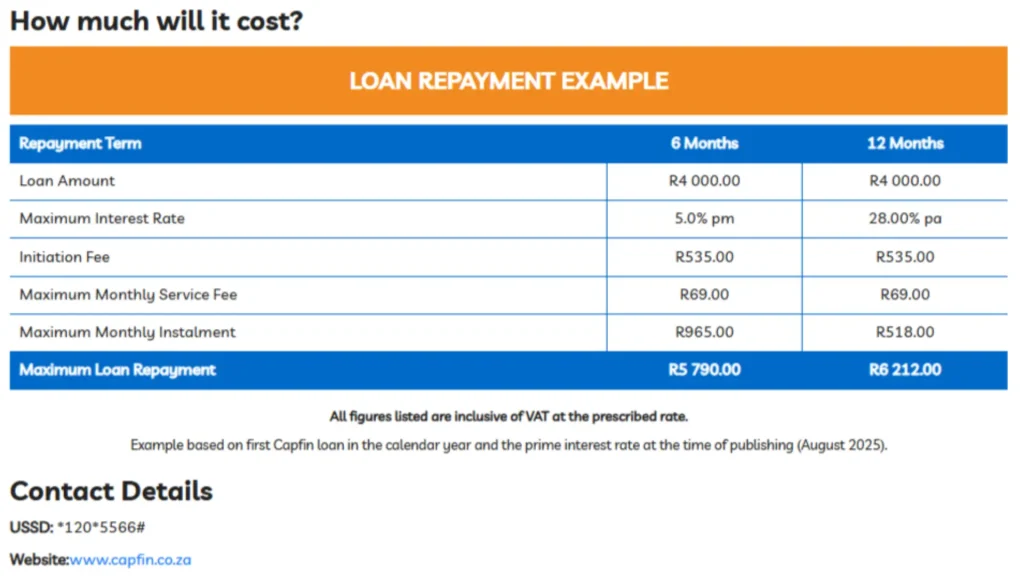

What is the maximum loan amount from Capfin?

The maximum loan amount from Capfin is R50,000 based on your bank transaction history. The repayment period for this particular amount is 6 to 12 months. In addition to transaction history, Capfin also lends the same amount if you have also purchased products equal to or more than this amount from PEP or Ackermans Stores.

How long does it take for a Capfin loan to be approved?

There is no set time for Capfin loan approval. If your bank statement is strong, the loan approval will be done within a few hours. In short, if your documents are solid, the approval usually takes only a few hours. However, in some cases, it may take up to 3 working days. Furthermore, if you are a regular Capfin customer who borrows and repays on time, you can get a loan in just a few minutes.

Can I get a loan without a payslip?

Yes – you can get a loan without a payslip. To do this, submit a bank statement, regardless of whether it shows a credit history. You can also provide proof of income, such as cash receipts instead of bank statements. If you don’t have any proof, open a bank account with a South African Bank and provide your bank account number.